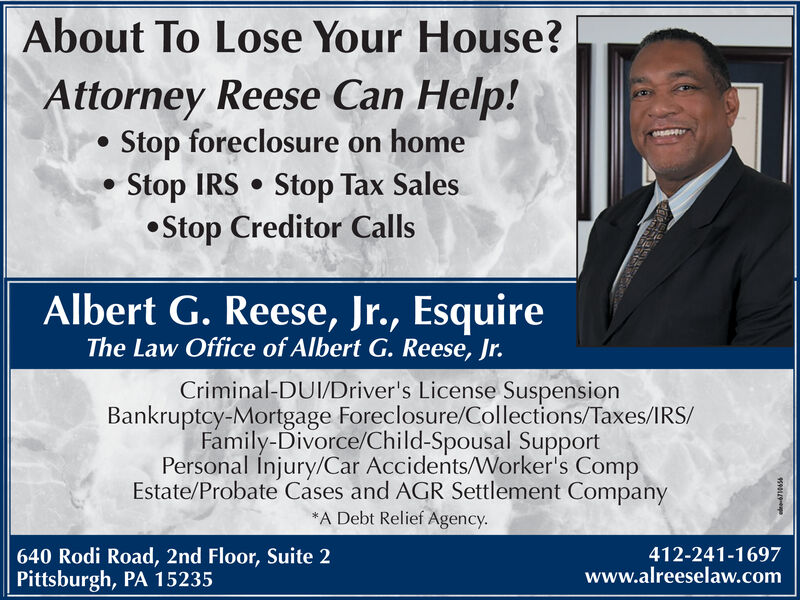

This is applicable to most scholar loans, together with federal loans and a few qualifying personal loans. Superior Court Judge Jan Jurden ruled Thursday that State Auditor Kathleen McGuiness is entitled to a public defender, but that she just isn’t entitled to a non-public attorney at taxpayer expense. However, a tax attorney may help scale back your IRS penalties and presumably keep you out of prison. CPAs consider the tax advantages of particular business practices while tax attorneys interpret tax laws to help businesses comply with IRS guidelines when selling or distributing products in multiple states. You want an expert to information you thru all the tax laws relevant to your case as effectively because the processes of the IRS. Provide expert recommendation on what they discover. Below you’ll discover some widespread situations in which people enlist the help of a high tax lawyer in Atlanta, Georgia. Thousands of individuals ask Thervo for legal advice yearly. When it’s time to file taxes, many small companies have particular tax preparation needs they didn’t encounter the previous yr and will not know whom to call for professional steerage. Whenever you seek the advice of our attorneys concerning your tax points, we’ll not only aid you resolve them but additionally provide personalized legal guidance to stop any comparable issues from occurring in the future, setting you forward on the path to success.

This is applicable to most scholar loans, together with federal loans and a few qualifying personal loans. Superior Court Judge Jan Jurden ruled Thursday that State Auditor Kathleen McGuiness is entitled to a public defender, but that she just isn’t entitled to a non-public attorney at taxpayer expense. However, a tax attorney may help scale back your IRS penalties and presumably keep you out of prison. CPAs consider the tax advantages of particular business practices while tax attorneys interpret tax laws to help businesses comply with IRS guidelines when selling or distributing products in multiple states. You want an expert to information you thru all the tax laws relevant to your case as effectively because the processes of the IRS. Provide expert recommendation on what they discover. Below you’ll discover some widespread situations in which people enlist the help of a high tax lawyer in Atlanta, Georgia. Thousands of individuals ask Thervo for legal advice yearly. When it’s time to file taxes, many small companies have particular tax preparation needs they didn’t encounter the previous yr and will not know whom to call for professional steerage. Whenever you seek the advice of our attorneys concerning your tax points, we’ll not only aid you resolve them but additionally provide personalized legal guidance to stop any comparable issues from occurring in the future, setting you forward on the path to success.

Organising a gathering with a Tax Advocate. Running a small business and meeting your tax obligations may be difficult, particularly for startups which have little expertise. Both CPAs and tax attorneys are ready to provide tax planning help and they can present help to people and organizations concerning financial decisions by focusing on the attainable tax advantages or penalties of those decisions. Most of our tax lawyers have been employed by the internal Revenue Service’s Office of District Counsel as Senior Tax Attorneys, and have been practising as tax legal professionals for anywhere from 10 to 30 years. After an agent finds an individual or company that owes back taxes, they’ll turn over the account to the revenue officer. Sometimes a taxpayer will receive a discover equivalent to a CP15 discover, 504 Notice or examination/audit request regarding international related penalties. In this case, if you’re feeling snug responding to the request or can hand off the correspondence to your accountant to deal with, an attorney isn’t vital. While most tax attorneys dont assist with tax return preparation and filing, an accountant can assist in this capacity.

Tax issues similar to late filing, trouble paying, being accused of tax fraud, or being chosen for a tax audit are widespread instances for many Americans. But dealing with tax issues on your own can open you as much as missing documentation or unhealthy filing, which might then result in an enormous tremendous by the IRS and attainable jail time. Just as Benjamin Franklin said, “Nothing is sure except loss of life and taxes,” you’ll most likely need to call a CPA or tax lawyer at one time or another (and in response to that assertion a mortician too, but that’s a different matter for one more time). What it means is they don’t have a license to signify you and in the event that they did they can be referred to as an lawyer, Enrolled Agent, or CPA. In this text, we focus on what a tax attorney is, why you should consider working as a tax attorney, the distinction between tax attorneys and CPAs and tips for becoming a tax attorney. That is why you need to hunt the advice of knowledgeable lawyer who is aware of the strategy of tax law in Las Vegas as a way to deal with the tax downside that you are dealing with.

Patricia. “It’s tremendously satisfying when we resolve a difficulty.” Jeff values his coworkers, the very people who find themselves invaluable to his groups. Some individuals assume they will deal with tax issues on their own, and keep away from paying for an attorney. There are Two very Big reasons to Only rent a tax attorney. Bar exams take two to 3 days to complete. Kells stated the commission ruled that the two workers who testified about their job status were not workers, but that others who didn’t seem earlier than the panel were employees. CPAs are certified to file experiences for the Securities and Exchange Commission, which are required for corporations who commerce in the inventory market. A certified public accountant can file reviews with the security and Exchange Commission (SEC) and therefore work with companies who trade on the inventory market. With Defense Tax Partners, you’ve skilled lawyers by your side who will not be just sharp and aggressive when it comes to managing your case and representing you in court docket but additionally compassionate and devoted to helping you gain control over your monetary life as soon as potential. While accountants and CPAs are more focused on managing your finances and filing tax returns, a tax attorney offers with the legal facets of financial proceedings including payroll taxation points, worldwide business tax legal guidelines, filing a lawsuit towards the IRS or representing you if the IRS recordsdata a lawsuit towards you, IRS criminal investigations, or tax fraud investigations.

A CPA is an individual skilled in managing cash. Some could wish to extend their training even farther equivalent to getting a master of laws degree in taxation or a CPA license. Received her bachelor’s diploma from the University of California. 171.500 di California. Pertimbangan seperti pajak, biaya hidup, dll sangat penting. Sales taxes are the purview of the California Department of Tax and Fee Administration (CDTFA). What’s the attorney’s payment construction? What’s the attorney’s success fee when coping with IRS issues? For this alone, you may want to contemplate hiring a tax attorney to handle your financial affairs when dealing instantly with the IRS. Don’t be alarmed by the term “power of lawyer.” Unlike a POA used in estate planning, Form 2848 doesn’t give the attorney broad powers to handle your financial affairs or make medical decisions. Now that you understand what does a tax attorney does, you possibly can consider whether or not or not hiring one is right for you.

A CPA is an individual skilled in managing cash. Some could wish to extend their training even farther equivalent to getting a master of laws degree in taxation or a CPA license. Received her bachelor’s diploma from the University of California. 171.500 di California. Pertimbangan seperti pajak, biaya hidup, dll sangat penting. Sales taxes are the purview of the California Department of Tax and Fee Administration (CDTFA). What’s the attorney’s payment construction? What’s the attorney’s success fee when coping with IRS issues? For this alone, you may want to contemplate hiring a tax attorney to handle your financial affairs when dealing instantly with the IRS. Don’t be alarmed by the term “power of lawyer.” Unlike a POA used in estate planning, Form 2848 doesn’t give the attorney broad powers to handle your financial affairs or make medical decisions. Now that you understand what does a tax attorney does, you possibly can consider whether or not or not hiring one is right for you.

As well as, both CPAs and tax attorneys might help people and companies defend themselves concerning tax associated issues. In case you need assistance to legally minimize your tax obligations and liabilities in the future. Additionally, a CPA could also be in a position to provide money administration advice, enable you to price range for tax payments and future purchases, and help you with different financial planning issues. Only attorneys are legally exempt from being compelled to testify in opposition to it’s best to the IRS prosecute you criminally sooner or later. However, should you decide along the best way that being a tax attorney might not be for you, then you must look at other jobs and career opportunities that may use your tax experience inside the authorized subject. If you are being criminally investigated for tax fraud or evasion. This earns them the precise to call themselves a specialist in federal, state, and native tax legal guidelines and insurance policies. The complexity of United States tax laws can go away taxpayers a bit confused, especially when trying to work by way of issues with the internal Revenue Service.

The Division of Taxation on the Colorado Department of Revenue handles the gathering and enforcement of state taxes in Colorado. He handles the state of affairs of your tax funds. Your total repayment amount could also be larger than the loans you might be refinancing even if your month-to-month payments are lower. Even the smallest of tax downside can turn out to be a giant one if not handled in the right manner. May be compelled to testify against you in a criminal trial! Employers regularly run into legal hassle when they fail to withhold, match, and/or deposit payroll taxes as required, which may end up in a belief fund restoration penalty (TFRP) or even criminal fees arising from willful employment tax evasion. Your comprehensive benefits bundle will embody paid time off, medical, dental, and imaginative and prescient coverage, incapacity and life insurance, an worker assistance program, a cafeteria plan, parental leave, a 401(okay) plus match, and paid parking.

The Division of Taxation on the Colorado Department of Revenue handles the gathering and enforcement of state taxes in Colorado. He handles the state of affairs of your tax funds. Your total repayment amount could also be larger than the loans you might be refinancing even if your month-to-month payments are lower. Even the smallest of tax downside can turn out to be a giant one if not handled in the right manner. May be compelled to testify against you in a criminal trial! Employers regularly run into legal hassle when they fail to withhold, match, and/or deposit payroll taxes as required, which may end up in a belief fund restoration penalty (TFRP) or even criminal fees arising from willful employment tax evasion. Your comprehensive benefits bundle will embody paid time off, medical, dental, and imaginative and prescient coverage, incapacity and life insurance, an worker assistance program, a cafeteria plan, parental leave, a 401(okay) plus match, and paid parking.

Whether we need to negotiate for a payment plan, provide a compromise, or declare a non-collectible standing, we will execute the plan that can work finest for you. You should also hire a tax attorney in case you are underneath criminal investigation by the IRS, you are planning to convey a suit against the IRS, otherwise you plan to seek an impartial evaluate of your case earlier than the US Tax Court or the tax courtroom in your country. Criminal instances relating to tax contain white collar crimes like fraud, however will not be as grueling as attempting heinous crimes like homicide. If you’re dealing with an audit with the potential for harsh penalties, a tax attorney could be the higher choice because of their negotiation expertise and intimate information of authorized ideas and case regulation. He also faces a period of supervised release, financial penalties, and restitution. They complete five-12 months degrees in business, move a significant certification examination, and must complete 120 continuing training hours in each three-year period. Except for the power to represent you in court docket, there may be another main purpose to think about a tax attorney over a CPA when coping with the IRS. For common tax questions or help getting ready or amending your tax return, you’re higher off hiring a certified public accountant (CPA), enrolled agent, or qualified tax preparer from H&R Block.

Answer any questions you may have. The answer depends on the specifics of your tax situation. Putting your legal professional in charge of talking to the IRS can go a long way in decreasing among the stress of dealing with tax problems. Hamlett, 32, awaits trial in December on a charge he misused a Social Security quantity. Although plenty of entities are responsible for creating and imposing tax legislation, including municipal, federal, and state governments, many tax relief attorneys specialize in Internal Revenue Service (IRS)-related points. In reality, some universities work collectively to offer a variety of joint packages for individuals enthusiastic about obtaining advanced training in tax legislation and accounting or enterprise. Many enrolled brokers are former IRS employees, though non-employees may full the coaching and examination to turn into enrolled brokers. Training of the tax attorney. Alleviate Tax has a historical past of offering outcomes like IRS installment agreements and gives in compromise.If you’re looking for a high-rated tax attorney that also gives clear pricing, consider Alleviate Tax. We searched for prime Tax Law Attorneys serving Denver, CO. Looking for extra companies?

The firm is searching for someone with an entrepreneurial spirit; they’re trying for someone able to maintain a blog, publish materials, conduct seminars, act as an adjunct professor, headline skilled talking engagements, or all the above. Joe commonly advises NYC shoppers about tax relief, helps them with tax planning, helps them deal with back tax issues and disputes, and ensures they’re correctly represented when back tax issues require rapid tax decision. A tax attorney is in a greater place to help when your tax scenario might involve potential courtroom-primarily based issues like wage garnishment, account levies, and property liens. This place will also provide you the opportunity to mentor greener attorneys who’re simply beginning to build their practice. Given our excessive ranges of expertise, we are in a greater place to know what the IRS is requesting and how you can reply most honestly and beneficially on your behalf. A superb tax attorney can assist you file an attraction of a tax courtroom choices, talk effectively with IRS officials, and assist your online business save cash by making the most of tax credits.

If you’re in that place, you might be questioning whether or not to rent a certified public accountant or a tax attorney. Don’t take the risk of hiring a certified public accountant for detailed tax questions. For these conditions, tax attorneys supply extra specialization within the authorized questions of tax planning whereas CPAs have more expertise on the monetary implications. Ask yourself these questions to search out out. We all know that there are plenty of good people who just discover themselves in a nasty state of affairs. Many individuals are wondering why there are such a lot of legal professionals operating round in the country. Thats why so many Americans hire a tax skilled to guide them through tax preparation and tax resolution conditions. You possibly can begin by questioning exactly why you need to pay what the IRS wants you to pay. When the IRS is making an attempt to levy your accounts or garnish your wages. There a lot of things involved within the bank reconciliation accounts payable or receivable and data.

There are several things it is best to consider as you assess your options. There ARE Solutions to your tax drawback. Stress-free as possible. After a thorough evaluation of your state of affairs, our tax attorney will present you with all of the potential options. You don’t have to lose sleep over how you’ll negotiate with a income officer on your own. While tax attorneys could have barely varying specialties, one thing most tax attorneys have in frequent is expertise in tax controversy and dispute decision. Unfortunately, it’s fairly common for tax decision firms to assert they have attorneys on staff when they really don’t. Unfortunately, these issues turn out to be fairly common for many individuals. It’s simpler to work with folks you know, so it’s worth your whereas to take a position time into constructing a relationship. For varied out-of-state tax returns, financial and estate planning, asset management, or audits, a CPA is nicely price the extra expense. Should you call your CPA or tax preparer with a tax problem that’s beyond the scope of their practice, they’ll seemingly refer you to an experienced tax attorney.

Financial assertion audits. CPAs are identified for making a profession out of preparing taxes, but that’s not the complete vary of their potential companies. In each tax relief situation, consider the actual tax services you need and how a lot youre prepared to spend before making a last decision. Thus, the services of a tax attorney will often price a lot more than the providers of an enrolled agent. He can offer you advice and recommendations that can assist you figure out what choices you might have so as to clear off your monetary report without having to declare bankruptcy or go into foreclosure. Forensic accounting services. When a business suspects embezzlement, a CPA can dig by the firm’s monetary information as far back as attainable to uncover fraudulent exercise. A CPA has been skilled. While individual states enact their own necessities for taking the CPA examination, most require a minimal of one hundred fifty college credits which is about 5 years of study. Most full-time legislation college packages last three years. A tax attorney is a lawyer who focuses on tax legislation. Money tax attorneys are the persons who take the complete responsibility of representing their purchasers in the courtroom.

The perfect potential factor you may do right away, is to take motion to keep away from extra penalties and interest expenses down the highway. Delinquent Tax Returns: Filing outstanding tax returns means that you can carry your account with the IRS present, however filing late can even result in substantial interest charges and penalties. A suggestion in compromise allows you to pay a a lot smaller amount of tax debt than you already owe. Results: The IRS accepted our provide of $20. Though Joe’s work is primarily transactional, he has additionally represented clients in IRS tax audits and appeals matters (so-called tax controversy work). International Tax. Should have information and expertise in representing clients in tax regulation and international matters. You’ll be able to feel comfortable spilling all the nitty-gritty details associated along with your scenario so that your lawyer can get a full-picture concept of where you’re coming from, how your problems formed, and how they could must act that can assist you solve your points. Just because you just like the lawyer you have met with, doesn’t suggest they’re the correct fit for you.

Each state has its personal set of requirements that must be met before one could obtain a license; there isn’t a nationwide CPA license. You can set up an installment settlement by yourself online or with the assistance of your CPA. Finally, somebody looking for a CPA license must go the Uniform CPA examination. Finally, both CPAs and tax attorneys will need to have had in depth schooling to apply in their fields. We have now prevented purchasers from paying a big sum in curiosity, again taxes, and different penalties and resolved their tax points. Most rookies start out earning their tax attorney earnings with a big law firm that has a different tax practice. The job of a tax attorney requires full data of all of the involved laws, a great financial mindset and the power to negotiate hard bargains and offers with the opposite celebration. Not everyone deals with it. How to save cash via that decrease one’s tax liability burden. Anything you inform your CPA might be divulged to the IRS or in court; for instance, if you’re hiding money in an offshore account. Furthermore, a tax attorney gives the advantage of lawyer-consumer privilege while a CPA only offers legal professional-shopper privilege if appearing at the direction of a lawyer to provide the consumer info related to the case.

The most effective Atlanta tax lawyer may also help you through many tax-associated challenges, and when in doubt, you must always schedule a consultation to let a licensed legal professional evaluate your case. Meanwhile, many tax attorneys even have earlier career experience in roles comparable to legal extern or lawyer. New York Tax Attorney, New York Bankruptcy Attorney, New York Traffic Ticket Lawyer undoubtedly might affect drivers in kings, nyc, we, nassau and queens have likewise seen them affect Ontario and Quebec licenses. To develop into a tax attorney, the first professional degree which is given to legislation faculty gradates is Juris Doctor or also known as an legal professional at law. Shawn has achieved excessive marks throughout his academic profession graduating with honors in both his Bachelors (BSBA) and Juris Doctor (Law Degree) programs. Becoming a licensed CPA expands career alternatives. We’ve the know how you can not solely do detailed evaluation your information with the eyes of a CPA but in addition find out how to aggressively argue in your behalf as an legal professional in entrance of the U.S. For those who suspect that your tax problems will result in authorized points otherwise you want authorized advice regarding tax matters, a tax attorney might be your finest wager.

What it’s best to do straight away is to seek the advice of a legal counsel so that you simply will not make errors. Need legal counsel across the tax structure of your organization. When working for individuals, CPAs assist doc revenue and exemptions for yearly tax returns. Married taxpayers filing jointly, head of household, and qualifying widowers with one or more dependent kids also can earn extra gross revenue earlier than they’re required to file earnings taxes. For basic tax filing and enterprise advice, an accountant could suit your wants. While some people can keep away from the filing of revenue tax, the truth is that most individuals dwelling and working within the United States will probably be required to file by the April 15 filing deadline. For instance, CPAs will alert the client if they uncover any obvious materials misstatements. For instance, the IRS sends CP501 to remind you that you’ve an unpaid balance due for the tax yr. Each year not more than 5 percent of the attorneys in the state are selected for the Super Lawyers list, and not more than 2.5 % for the Rising Stars checklist.

The threshold for property tax liability tends to rise every year. Tax attorneys usually specialise in areas of property planning and transfers, property acquisitions, and business transactions that result in advanced tax liability. Americans are suffering from staggering enterprise losses and job losses- and the discount of taxes and your tax legal responsibility is crucial. The location hyperlinks customers to native job postings. Student mortgage gives that appear on this site are from companies or associates from which solvable may obtain compensation. No matter what your legal problem could also be, it is always finest to hunt legal assist early in the process. Your CPA, regardless of how trustworthy, does not have the same authorized protection. If you are unsure of how you can make the IRS appear to be you’ve gotten a real enterprise and never a pastime, search assist from the tax attorney Los Angeles. Any information you provide your tax attorney is protected by client-legal professional privilege, which means they can’t be compelled to testify in opposition to you.

While a breach of confidentiality would actually mirror poorly on a CPA and probably be a breach of ethics, attorneys are bound by shopper-lawyer confidentiality rules. A CPA can also provide tax resolution services, although he or she can not represent you in a court docket of regulation. As a result, tax attorneys can enable you save tons of, hundreds, or even more. When your tax and authorized issues are too complicated to handle on your own – and even with the help of your accountant – hiring a tax attorney is smart. Among the largest needs we discover lots of truck drivers need when it pertains to their taxes is for a wonderful bookkeeper or accountant who may help them. In return, you’ll be able to anticipate a collaborative and professional workforce who enjoys a healthy work/life stability. When you are an skilled in your small enterprise business, it will possibly seem daunting to cowl all of the demands that operating a enterprise of your own requires. Currently, they have more than 50 programs that cover tax laws for domestic and worldwide dealings. They’re additionally skilled at maintaining with modifications to the legal guidelines themselves, in addition to how the IRS interprets them. Since CPAs are licensed through the state, they’re certified to follow solely within the state that has granted their license.

They’re additionally licensed to follow regulation. Once you understand that your preferred lawyer is legally allowed to practice regulation, look for further skills. You may additionally want to see if you possibly can take a apply take a look at to organize your self for the true thing. I see or discuss to my CPA about as soon as per week. We take a quick look and see the Attorney has 5 different tax web sites, each one touting “Expertise” in a special area of legislation. As part of your individualized plan, a Houston tax attorney will clarify to you the distinction between providing a lump sum OIC and a payment plan OIC. You will be properly guided via all the proceedings that will come your manner relating to the matter of your unpaid taxes. In some cases, something reported on a tax return might have prompted the IRS to look just a little deeper into the matter for doable infractions. If you’ve been taking part in quick and free with IRS rules, you won’t be capable to avoid all trouble. Your heirs won’t should pay so much in taxes. Above all, the key is to act quickly as a result of it won’t get higher by waiting. While it is engaging to get the service is over CPAs or Tax Attorneys as a result of decrease charges they charge, you should act with warning as a result of there are cases when it’s better to seek the assistance of a Tax Attorney or CPA.

3,162 total views, 1 views today