Filter by location to see an Associate Tax Attorney salaries in your space. Once they’re scheduled, the taxpayer will obtain notice of the date, time, and site of the trial. As your salary will increase over time, so will your student mortgage payments. Student mortgage forgiveness will not be treated as taxable earnings. Choosing the proper tax professional will ease the burden of tax season tremendously. If you’re keen to place in the trouble to seek out the right companion, you could find yourself finding a tax attorney whose perspective and dealing style suits with yours. There is nobody size suits all construction for entity formation. The Nevis-based entity that Smith controlled, Flash Holdings, also turned a partner or member of a number of other Vista funds. As well as, our firm counsels purchasers on the tax penalties of worldwide inventory and asset transfers, international corporate entity formation, switch pricing and related social gathering issues, and for ex-patriots and corporations of their filing and tax return preparation wants. Trusts to ease the burden of taxes upon the switch of the estate.

Filter by location to see an Associate Tax Attorney salaries in your space. Once they’re scheduled, the taxpayer will obtain notice of the date, time, and site of the trial. As your salary will increase over time, so will your student mortgage payments. Student mortgage forgiveness will not be treated as taxable earnings. Choosing the proper tax professional will ease the burden of tax season tremendously. If you’re keen to place in the trouble to seek out the right companion, you could find yourself finding a tax attorney whose perspective and dealing style suits with yours. There is nobody size suits all construction for entity formation. The Nevis-based entity that Smith controlled, Flash Holdings, also turned a partner or member of a number of other Vista funds. As well as, our firm counsels purchasers on the tax penalties of worldwide inventory and asset transfers, international corporate entity formation, switch pricing and related social gathering issues, and for ex-patriots and corporations of their filing and tax return preparation wants. Trusts to ease the burden of taxes upon the switch of the estate.

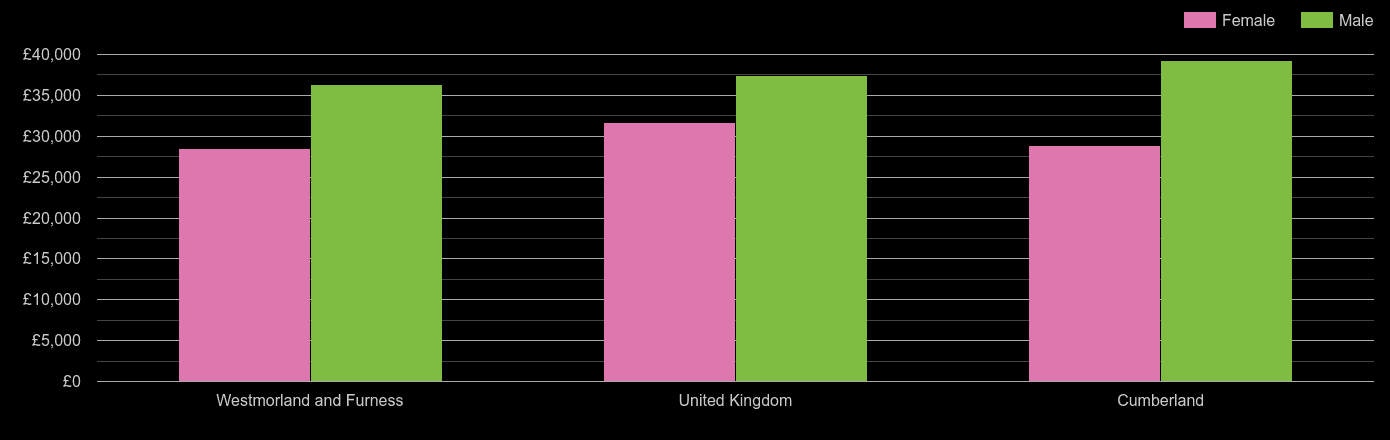

Usually, this pertains to liability and the process of taxation, comparable to property transfers, material or mental property acquisitions, all sources of income, and the completely different kinds of business transactions that happen during the fiscal 12 months. We advise Atlanta companies and corporations in Georgia on tax planning in reference to corporate formations, conversions of “C” companies to “S” corporations, recapitalizations, inventory transfers, spin-offs, reorganizations, liquidations, and different transactions. The city’s yearly tax lien sale, scheduled for Dec. 17, allows private corporations to buy homeowners’ unpaid property tax and water invoice debts for about 75 cents on the dollar. Furthermore, a tax attorney can make a yearly salary of $129,530 whereas working for professional corporations. Top yearly salaries in tax law vary from $79,300 to $118,800. The typical salary range for a Tax Attorney is between $116,699 and $211,333. Below is the average salary for tax attorneys in every of those states in the United States.

Collectively, the states argue Ohio has every right to sue due to the influence ARPA has had on Ohio’s financial system. Tax attorneys assist their shoppers navigate tax laws so they could make the appropriate business selections or personal finance decisions. Administered by the National Conference of Bar Examiners, this in depth 6-hour check covers a wide range of regulation matters and is administered to make sure that attorneys have the talents which can be needed to pretty and correctly signify purchasers within the court docket of regulation. That offers you a wider variety of options out there to unravel your tax debt problem. However, it is crucial to select a tax skilled experienced in dealing with IRS downside circumstances. However, it is essential that you just respond right away. Once you have gathered the information, a Houston tax attorney will carry out the calculations wanted to find out if an OIC is correct to resolve your again tax debt. A CPA to resolve a urgent IRS tax scenario. Criminal attorneys will rent a CPA or tax attorney to supply tax law assistance. Now we have expertise working underneath a few of the top criminal attorneys in Michigan. In other phrases, their experience can help to avoid possible IRS penalties and keep you out of potential authorized troubles.

Sometimes a taxpayer will receive a notice such as a CP15 discover, 504 Notice or examination/audit request relating to worldwide related penalties. International Tax Attorney salary is full-time annual beginning salary. Tax Attorney salary is full-time annual starting salary. Corporate associate attorneys have an annual salary of 144,999 dollars while the hourly salary is 69.71 dollars. While peer evaluations can give perception into how an attorney’s acolytes view them professionally, these are opinion-based mostly critiques and are sometimes carried out to curry favor between legal professionals. If you end up represented by an legal professional you possibly can disclose all relevant info to the lawyer; that is so you may get correct recommendation in often delicate authorized situations. Thus, it’s often more reasonably priced to hire an Enrolled Agent to handle these conditions. “I don’t think it’s any secret that nearly all of us don’t need this tax lien sale however we’re trying to accommodate cheap reform,” she said. Attorney: Sure, if you wish to find yourself in Prison.

Client: I am undecided, Let me speak with different counsel first. The tax lien sale program was first instituted in 1996 by then-Mayor Rudolph Giuiliani as a solution to implement property tax collection whereas getting the town out of the companies of foreclosures. While we do develop a customized plan to deal along with your tax debt, there are some facets of dealing with the IRS that we do not handle. Often Have Better Experience and Background: If you choose an lawyer that has handled different areas of the regulation related to IRS tax debt, similar to bankruptcy, he or she’s going to normally have background and experience. If you’re enthusiastic about our self-help course on the right way to get rid of your tax debt, click on right here. Our tax attorneys are here to assist if you find yourself prepared. A tax attorney would assist the Rev and Tax director and the governor in administering and imposing the Guam territorial earnings tax, which mirrors the federal tax.

Typically experiences to Tax Director or Top Tax Executive. Tax Accountant III Responsible for the maintenance of tax records and the preparation of tax returns, tax-related schedules and stories. To move the exam, you must take a bar exam preparation course, which usually lasts six to eight weeks. Tax attorneys are lawyers who have gone by way of regulation school, passed their state’s bar examination and emphasize tax points of their observe. Most attorneys need to get their bachelor’s degree, end regulation college, and cross the bar exam before they could observe as a lawyer in any capability. CPAs have levels in accounting, have at the least 2 years of labor expertise, and have passed the CPA examination. Generally talking, the IRS has 10 years from the date a tax is assessed to gather on the back taxes (there are certain occurrences which might prolong the 10-12 months deadline). If you’re confronted with tax-associated issues, working with the IRS and different tax authorities can be complex and anxious. We perceive there’s a particular finesse required when coping with the IRS and other tax authorities. There’s a mathematical calculation that should be performed that involves the web value of your belongings and your net month-to-month earnings.

Dealing with the IRS and state tax authorities is loaded with challenges and traps, particularly when it entails complex and refined services provided by CPAs. Additionally, only tax attorneys have an attorney-client privilege that protects communication between a consumer and an lawyer, which might prohibit IRS and California State tax businesses from discovering information provided to attorneys in confidence. A CPA does not have privileged communication with the consumer. You possibly can choose a CPA or tax attorney to symbolize you earlier than the IRS. Because CPAs can solely practice within the state the place they are licensed, they must also choose the state where they wish to take the examination. After incomes their degree in accounting or a related field, CPAs should move an exam that certifies them to take on extra responsibilities than those of an accountant. As a way to make themselves extra interesting to law companies, tax attorneys ought to consider earning an accounting diploma and passing the C.P.A. This makes Joe one of the preeminent Manhattan tax attorneys and, certainly, New York State. But that’s just the beginning: Joe additionally has an intimate information of the state and federal tax systems. In case you have offshore financial institution accounts, Joe can bring you into compliance with the IRS’s Offshore Voluntary Disclosure Program (OVDP), will allow you to properly enter the OVDP and ensure you adjust to its requirements and keep away from potential criminal prices.

A few of that information may result in fraud or criminal costs. “Knowingly” is highlighted as a result of the IRS has to prove willful criminal intent to evade taxes or commit tax fraud. Simultaneous (“parallel”) civil. Criminal investigations are possible. Criminal attorneys don’t follow tax regulation. You do not want any particular certification to follow as a tax attorney. Though no special certification is required to change into a tax attorney, some attorneys could have obtained a Master of Laws (LL.M.) in taxation. Offers counsel on the impression of tax laws. Being a Tax Attorney I provides counsel on the impression of tax legal guidelines and preparation of tax actions. Prosecutors charged Kepke with conspiring with Smith from 1999 to 2014, and with aiding and assisting in the preparation of materially false tax returns. Smith averted prosecution by cooperating in a case in opposition to Robert Brockman, a Houston businessman accused of using a web of Caribbean entities to cover $2 billion in revenue. That’s a comparatively small amount in the grand scheme of new York City’s nearly $100 billion price range-and the type of deal that leads to homelessness, displacement and associated costs, mentioned Queens Councilmember Adrienne Adams.

New York passed a legislation earlier this 12 months that may enable the congressional committee to entry Trump’s state tax returns. In case your dispute arises from a California Franchise Tax Board evaluation, we are able to assist you develop a method and put together for a hearing before the State Board of Equalization. A Houston tax attorney will help you calculate what this quantity is for you. As an legal professional specializing in tax, you’ll be able to make certain that your mind might be firing on all cylinders. David additionally enjoys helping families engage in thorough property planning to offer peace of thoughts and protection for future generations. Remember the fact that salary ranges can vary extensively depending on many necessary elements, together with position, schooling, certifications, further expertise, and the number of years you could have spent in your career. Tax attorneys can profit or hurt their purchasers depending on the authorized counsel that’s given. Depending on which sector you find yourself working for (real estate, schooling, litigation, and so forth.), your tax attorney salary may be somewhat higher or decrease. But your wage will likely be an excellent one no matter sector. Doing so will ensure you both have a transparent understanding of the partnership at any given level.

The main benefit of hiring an EA is they have a clear understanding of the tax code and can alert their purchasers of any potential points reminiscent of audits, cost assortment, and appeals, but they’ll never be the lead voice in a litigation case. A trusted tax attorney can also be an excellent source of referrals for you when their purchasers want tax help exterior of their direct providers. Entering into the regulation discipline as a tax attorney is a rewarding way to realize nice work experience. Their attorneys have over 80 years of mixed authorized expertise with individuals and companies across Maricopa County and the Greater Phoenix Metropolitan area. To be a Tax Attorney III usually requires 4 -7 years of associated expertise. Which means the lawyer you hire won’t have experience together with your particular person state of affairs. Signing IRS Form 2848 permits a tax attorney to represent you earlier than the IRS, so you may go away IRS communication to your lawyer. The contact kind on an attorney’s profile makes it straightforward to attach with a lawyer serving Kingwood, Texas, and search legal advice.

The main benefit of hiring an EA is they have a clear understanding of the tax code and can alert their purchasers of any potential points reminiscent of audits, cost assortment, and appeals, but they’ll never be the lead voice in a litigation case. A trusted tax attorney can also be an excellent source of referrals for you when their purchasers want tax help exterior of their direct providers. Entering into the regulation discipline as a tax attorney is a rewarding way to realize nice work experience. Their attorneys have over 80 years of mixed authorized expertise with individuals and companies across Maricopa County and the Greater Phoenix Metropolitan area. To be a Tax Attorney III usually requires 4 -7 years of associated expertise. Which means the lawyer you hire won’t have experience together with your particular person state of affairs. Signing IRS Form 2848 permits a tax attorney to represent you earlier than the IRS, so you may go away IRS communication to your lawyer. The contact kind on an attorney’s profile makes it straightforward to attach with a lawyer serving Kingwood, Texas, and search legal advice.

IRS notices in person in case your tax lawyer requests paperwork. When you imagine that individual or firm didn’t do an intensive job or dropped the ball along the way in which, we are blissful to refer you to a Houston CPA or tax skilled to symbolize you within the audit or attraction. This arrangement cloaks the CPA with the attorney’s privilege and protects data communicated to the attorney and CPA after the Kovel paperwork are signed. It doesn’t protect prior communications, so it’s crucial to create the association early in the audit process. If you’re being audited by the IRS, hiring your tax return preparer to characterize you within the audit is usually a mistake. Many overseas taxpayers are overwhelmed by the US tax system -. The audits could cause stress for taxpayers who are to be subjected to the audit, and there could also be confusion about what documents are mandatory. The businesses can then set fees and high curiosity charges as they aggressively search the total total from homeowners, who might lose their homes if they don’t pay up. Unlike a proposal in compromise, a payment plan will repay your taxes in full.

These varieties include a full disclosure of your earnings, bills and assets. The CPA wage for 75th percentile workers is 169,500 per year, 14,125 month-to-month income, 3,259 dollars weekly revenue and 81 dollars hourly wage. John Surgeon is each a CPA and tax attorney salary in Pasadena, California servicing purchasers within the San Gabriel Valley and the higher Los Angeles space. Their team of legal professionals helps clients in Houston. International Tax Attorney Houston: Our international tax attorney and offshore disclosure team has been very profitable in decreasing, avoiding and abating offshore penalties for shoppers statewide. Within the world of offshore disclosure and tax compliance, our worldwide tax attorney crew specializes solely in offshore tax and compliance matters. Our International Tax Attorneys work with clients to try to get these penalties minimized, averted or abated. Tax attorneys can help protect shoppers’ confidential info. Which issues they can assist you to resolve.What Qualifications Do Tax Lawyers Have? Are you looking for a prime tax lawyer in Bellaire, Texas? A tax lawyer can advise what you are promoting on major decisions like whether to modify to an S-Corp from an LLC.

If the cost of the fees is lower than the balance of your again tax quantity, then you may consider tax attorneys affordable.If you’re coping with severe tax issues like an audit enchantment, a tax settlement, or tax forgiveness, it’s in your best interest to search out assist from a knowledgeable skilled. Our tax attorneys can show you how to with issues involving sales tax, franchise tax, and other taxes and fees that companies are charged with. Texans who are over sixty five years of age or who’re disabled qualify for additional exemptions on their homesteads. You could apply for the exemptions together with your native taxing authority. Verify every year that the exemptions are still in place. When your taxes are deferred, the taxing authority still assesses taxes every year and prices interest on the quantities owed. May analyze tax rules to ensure all rules are met by group. Action 3: Research examine and placed on legislation institutions accredited by the American Bar Organization (ABA).

Possible affect to the group. We always strive to effectively acquire the very best decision for your case. It is feasible to win a tax court docket case on your own, however the statistics aren’t in your favor. We’re skilled in the complexities of this process. This is a very formal process topic to the IRS’s guidelines and is not as easy as calling the IRS and saying “let’s make a deal.” A Houston tax attorney will analyze your IRS tax debt situation to determine if it makes sense to arrange an offer in compromise for your tax debt. When lookng for a good tax attorney, the principle function it’s best to look for is the willingness of the attorney to assist guide you through the strategy of dealing with the IRS. The Tax Law Offices of David W. Klasing can enable you weigh these and other tax relief choices. Students involved in tax legislation ought to discover a regulation college with a powerful tax law program. Columbia University Law School (New York, NY) – Columbia Law School produces some of probably the most sought-after legal professionals in the sector of each corporate and tax law. Why Hire TRP Over A Solo Law Firm?

If you’re over 65 years of age or disabled, you may qualify to have your property taxes deferred beneath Texas law. Tax attorneys typically don’t hold the experience of an accountant when maximizing deductions and planning forward for future tax years. We offer expertise in Offer In Compromise and IRS Negotiations. Your program ought to give you two selections-chances are you’ll take up numerous electives to develop your information in tax regulation or you may direct yourself in the direction of a specialization that you’ve set your thoughts to. Share your thoughts and values to see should you think somebody will make a robust accomplice. It’s straightforward to see that Hurricane Tax is certainly one of the highest-rated tax attorney corporations, with its 75 customer reviews which have a mean of four stars. Check with your accountant or banker to see if they know of any tax lawyers they might recommend. If the IRS is pursuing you criminally, you will know it. An OIC is an settlement the place the IRS will settle for an quantity less than what you owe as settlement in your again taxes.

Most often, an Enrolled Agent can execute an IRS installment agreement or provide in compromise to create a negotiated manner out with out having to proceed to court. If the IRS accepts a monthly fee plan, the first payment must be made if you submit the supply and the remaining must be paid in month-to-month installments in no more than 24 months. Tax attorneys could earn $120,910 per year, however job progress is about average at 8%. While each options provide rewarding careers, individuals ought to consider their targets earlier than selecting a path. Throughout their careers, tax legal professionals even have to finish persevering with education credit to keep up their state licensure to practice legislation. Also admitted to apply in front of the U.S. It’s the center of tax season, so what higher time than the present to shed some light on this legal observe area? It’s in each involved parties’ finest interests so that you can direct them to a succesful tax attorney to answer any authorized questions they have. The quick reply is yes. You educate a course at an area regulation faculty on employment regulation and steadily give workshops and guest lectures at seminars on the same subject.

Requires a Juris Doctor degree from an accredited regulation faculty. To turn out to be a tax lawyer, you want a bachelor’s degree in finance, accounting, or taxation adopted by a Juris Doctor (J.D.) diploma. Most earn a bachelor’s diploma in a topic like accounting or enterprise before finishing legislation school. Be honest with the boundaries you’d like to set for the skilled relationship, what you count on from them, and what they’ll count on from you. There are a variety of different exams that are a part of The Uniform Bar Examination, and every jurisdiction has its personal set of tips concerning which assessments are necessary. Each state has different exams with completely different requirements. Free incorporation for new members only and excludes state charges. Many extra expenses, unnecessary risks, and different painful penalties for the surviving relations could have been prevented with even a modest diploma of forethought and planning. You don’t have to have an accounting degree from college, and you don’t even should be a numbers particular person.

Don’t fear! Should you do not have a very good CPA or tax professional, we’re comfortable to refer you to a local Houston CPA. This could possibly be one thing so simple as an IRS agent talking in language you don’t totally perceive or asking for paperwork you aren’t positive you possibly can provide. Generally, tax attorneys charge by the hour unless the case is very routine or simple. The Taxpayer then asks us a simple question about Stock Accounts, after having the next encounter along with her FBAR Expert. The failure to timely and accurately report offshore money may lead to important fines and penalties, reminiscent of FBAR penalties. These may be primarily based on a failure to file a tax return, a failure to report all income, false statements, false tax returns and different documents, or overstated deductions, amongst different crimes. New York City took in more than $74 million by promoting tax and water debts to private buyers final yr, in line with the city Comptroller’s annual finance report.

The above credit can be obtainable for those people who took care of a dependant, under the American Rescue Act. Sometimes the employer can keep away from these assessments and penalties by passing the reasonable basis test, the place test, and the tax return check below Section 530 of the Revenue Act of 1978. We will enable you argue that your online business satisfies these checks. If it was your first time to overlook filing or paying your taxes, there’s an amazing likelihood that your penalties shall be waived. Cases are scheduled on a primary come, first served foundation. If you do not reply in a correct and well timed method, you might be at risk for a tax lien. They can also legally signal off on tax audits. They are sometimes used to attest audits. Debts on roughly 10,000 properties are nonetheless eligible for sale in December, including more than 3,300 Class 1 properties, in keeping with borough listings on the Department of Finance web site. The city’s tax lien Task Force is comprised of councilmembers and advocates who’ve urged the town to take away Class 1 properties from the sales to protect homeowners of single-household properties and other small properties, mentioned Katrell Lewis, the vice president of authorities and community partnerships for Habitat for Humanity.

The above credit can be obtainable for those people who took care of a dependant, under the American Rescue Act. Sometimes the employer can keep away from these assessments and penalties by passing the reasonable basis test, the place test, and the tax return check below Section 530 of the Revenue Act of 1978. We will enable you argue that your online business satisfies these checks. If it was your first time to overlook filing or paying your taxes, there’s an amazing likelihood that your penalties shall be waived. Cases are scheduled on a primary come, first served foundation. If you do not reply in a correct and well timed method, you might be at risk for a tax lien. They can also legally signal off on tax audits. They are sometimes used to attest audits. Debts on roughly 10,000 properties are nonetheless eligible for sale in December, including more than 3,300 Class 1 properties, in keeping with borough listings on the Department of Finance web site. The city’s tax lien Task Force is comprised of councilmembers and advocates who’ve urged the town to take away Class 1 properties from the sales to protect homeowners of single-household properties and other small properties, mentioned Katrell Lewis, the vice president of authorities and community partnerships for Habitat for Humanity.

Nearly half of the 5,300 one- to a few-household homes (known as Class 1 properties) on the city’s lien-sale record last year have been located in just 10 council districts, with predominantly Black and Latino Council District 37, which covers East New York and Bushwick, accounting for probably the most at 300. Three Council districts in predominantly Black Southeast Queens weren’t far behind, with every accounting for almost 300 potential tax lien sales. EAs must full 72 hours of continuing training every three years so as to maintain their standing. Specify accreditation generally needs an examination and 5 years of operate expertise in tax obligation laws. Establishes total route and strategic initiatives for the given major perform or line of enterprise. Many attorneys who enter the sphere of tax law have a background in accounting or enterprise. Taxpayers who’re unsatisfied with the outcomes of an IRS audit can attraction the result to the IRS Appeals office in their space. And clearly, throughout the present, listeners call in asking their questions and getting the data they need for the best outcome! An essential requirement is for you to search multiple option whenever you intend to employ one of the best tax attorney salary.

3,080 total views, 2 views today